Beginner's Guide To Medicare

Learning Medicare > Beginner’s Guide To Medicare

Key Takeaways

- Medicare consists of Part A, B, C, and D, as well as other insurance such as Medicare Advantage and Medicare Supplement plans.

- Medicare is a federally mandated program which provides comprehensive insurance to people 65 and older, or at any age below 65 who have qualifying disabilities.

- Many people enroll in Medicare during their 7-month Initial Enrollment period, which is 3 months before, the month of, and 3 months after their 65th birthday.

- Only Medicare Part A and B are administered by the government.

What is Medicare?

Medicare is the Federal government-administered health insurance program in the United States that provides comprehensive health insurance primarily for those who are 65 years of age or older, but it also covers younger individuals who have been disabled for at least 24 months, or at any age if diagnosed with Lou Gehrig’s disease (ALS) or End-Stage Renal Disease (ESRD).

History Of Medicare

The idea of national health insurance gained traction during the administration of President Harry S. Truman in the late 1940s and early 1950s. Truman proposed a universal national health insurance program in 1945, but it faced strong opposition and never materialized

The push for Medicare gained momentum in the 1960s. President Lyndon B. Johnson signed the Social Security Amendments of 1965 into law on July 30, 1965. This legislation established both the Medicare and Medicaid programs as amendments to the Social Security Act. Medicare was primarily designed to provide health insurance coverage for Americans aged 65 and older, while Medicaid targeted low-income individuals and families.

Since Medicare was implemented in 1965, it has evolved, undergoing several expansions and amendment to adapt to changing healthcare needs. For example, the addition of Medicare Part C (Medicare Advantage) in 1997 allowed beneficiaries to receive Medicare benefits through private insurance plans. Medicare Part D, which provides prescription drug coverage, was introduced in 2003 and implemented in 2006.

How Does Medicare Work?

In order to explain how Medicare works, we’ll need to go over the four parts of Medicare. Medicare is made up of four parts: Part A, Part B, Part C, and Part D. There are some other coverage options available such as Medicare Supplement plans which help limit financial risk, but everyone must begin their Medicare journey with Original Medicare (Parts A and B) . We’ll now go into more detail about each part of Medicare and the supplement coverages available to Medicare beneficiaries.

Medicare Part A & Part B (Original Medicare)

Original Medicare (also called Traditional Medicare) consists of Part A – Hospital Insurance and Part B – Medical Insurance. Original Medicare is where everyone must begin their Medicare Journey, because you need to be enrolled in Original Medicare to get any other supplemental insurances.

Medicare Part A is inpatient hospital insurance. Think of it as “room and board” coverage as an inpatient. It covers inpatient hospital stays, skilled nursing facility care (post hospital), general nursing, inpatient medications, hospice care, blood, and some home health care. Just a note, while Medicare does pay for necessary skilled nursing care, Medicare does not pay for long-term care such as nursing homes for custodial care.

Benefit Periods

Medicare Part A operates off of benefit periods, which start the day you’re admitted to a hospital or skilled nursing facility and end after you’ve been out of the hospital or facility for 60 consecutive days. If you return to the hospital after the 60 days, a new benefit period begins, meaning a new deductible must be paid. If you return to the hospital within the 60 day period, you will not owe a new deductible.

Part A Costs

While most people don’t pay a premium for Part A if you or your spouse have worked and paid Medicare taxes for at least 10 years (equivalent to 40 quarters), there are other costs such as deductibles and coinsurance. Beneficiaries may have to pay a deductible for each benefit period and coinsurance for extended stays in hospitals or skilled nursing facilities.

Even though Part A doesn’t have a premium, it does have other out-of-pocket costs. First, it has a deductible. The Part A deductible works differently than other health insurance deductibles you might be used to. Instead of an annual charge, it goes by benefit periods. A benefit period begins on the first day you become an inpatient and ends when you’ve been out of the hospital (or other facility) for 60 consecutive days.

Part A also has copays, which are based on the number of days you’ve been hospitalized. The first 60 days of a hospitalization are covered by Medicare. Copays begin on day 61.

Medicare Part B is also called outpatient or medical insurance. It covers visits to your doctor, imaging, lab tests, surgeries, durable medical equipment, and many preventive care services.

Part B does have a monthly premium. The Centers for Medicare and Medicaid Services (CMS) sets a standard premium each year. Most people pay the standard amount, but people with higher incomes will pay more. On the other hand, beneficiaries with limited incomes are eligible for Medicare Savings Programs, which can help cover the Part B premium.

Part B also has a deductible, but it is a smaller annual fee. Once you meet that deductible, Part B pays for 80% of covered services, leaving you with a 20% coinsurance amount.

Unlike traditional group health insurance, there is no out-of-pocket maximum under Original Medicare. While it does offer great coverage, it can leave beneficiaries with a large financial burden

Medicare Part C (Medicare Advantage)

Medicare Advantage, or Part C, are all-in-one alternatives to Original Medicare and Part D. They combine Parts A, B, and D, for a single healthcare plan. You must be enrolled in Original Medicare before you can enroll in a Medicare Advantage plan. Once you enroll in Medicare Advantage, all of your benefits are provided by the insurance company, not the federal government.

Medicare Advantage plans must offer at least as much coverage as Original Medicare, but almost all of them offer even more coverage. For example, you can bundle your prescription drug coverage into your Medicare Advantage plan – for no additional premium! Many plans also include benefits for hearing, vision, and dental care to name a few. They often include wellness programs, gym memberships, transportation, meal delivery, Part B credits, and monthly over-the-counter stipends to spend.

If you’re considering Medicare Advantage, it’s important to understand how these plans work and what the different options are. Medicare Advantage plans come in a variety of types, so you’ll need to work with an advisor to find out which one suits your unique needs.

One of the most attractive aspects of Medicare Advantage plans are their premiums…most plans offer extremely low monthly premiums, often as low as $0 per month. Of course, you should consult the plan’s out-of-pocket costs, including the deductible and all copays.

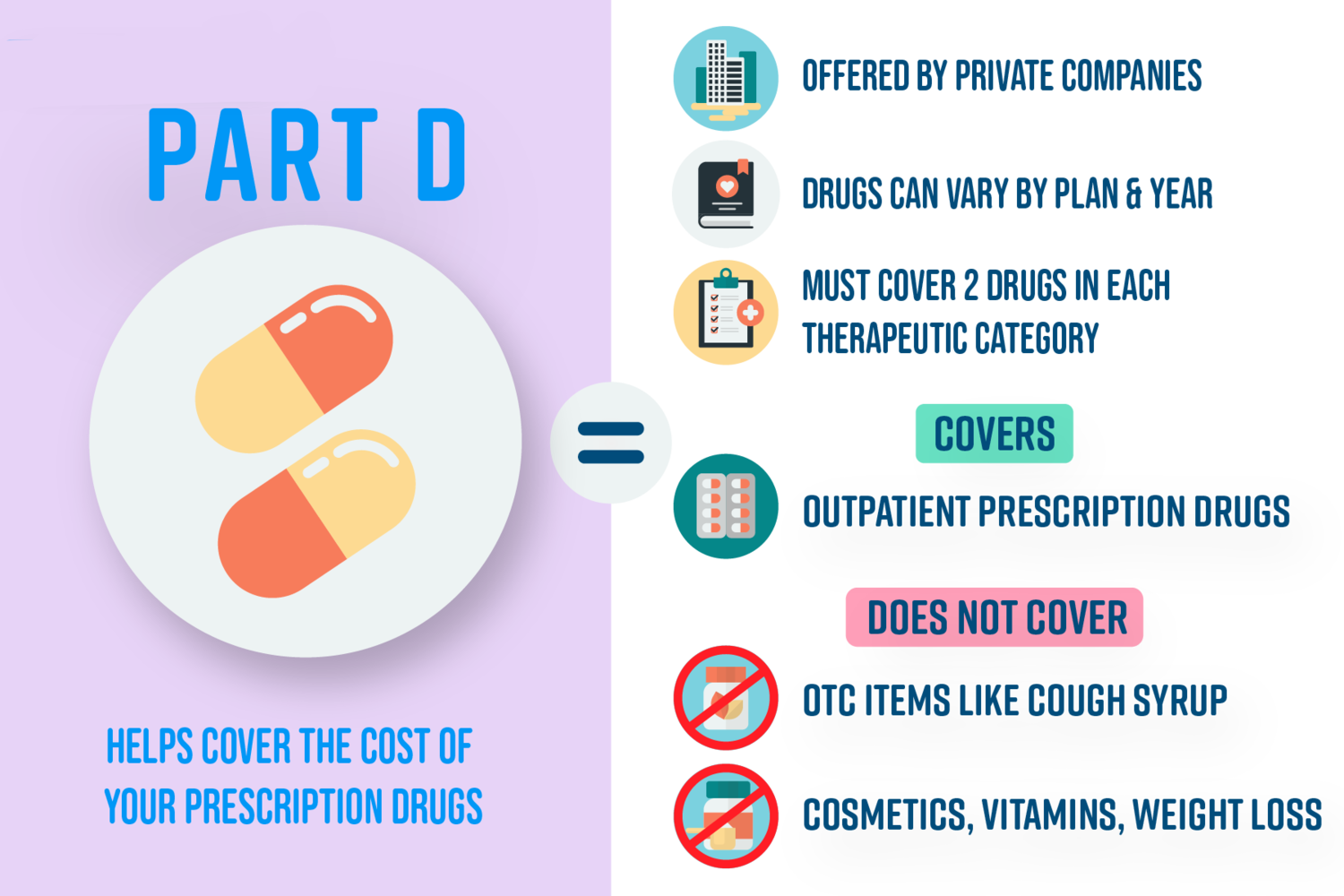

Medicare Part D

Medicare Part D is for prescription drug coverage. This part helps pay for the prescription drugs you pick up at a pharmacy. Prescription drugs aren’t covered by Original Medicare, so you’ll need a separate policy to get coverage for your medications. This even applies to people who aren’t currently taking prescriptions. Failure to enroll in Part D will result in financial penalties that last a lifetime!

Private insurance carriers sell Part D plans, and the plans will vary across the country. Part D plans can come as a standalone plan (If you have Original Medicare), or rolled into a Part C Medicare Advantage plan. To choose a Part D plan, you’ll need to compare their drug formularies to find out which plan covers all your prescriptions at the lowest cost to you. Formularies change every single year, and so do prices, so it is crucial you shop around every single year.

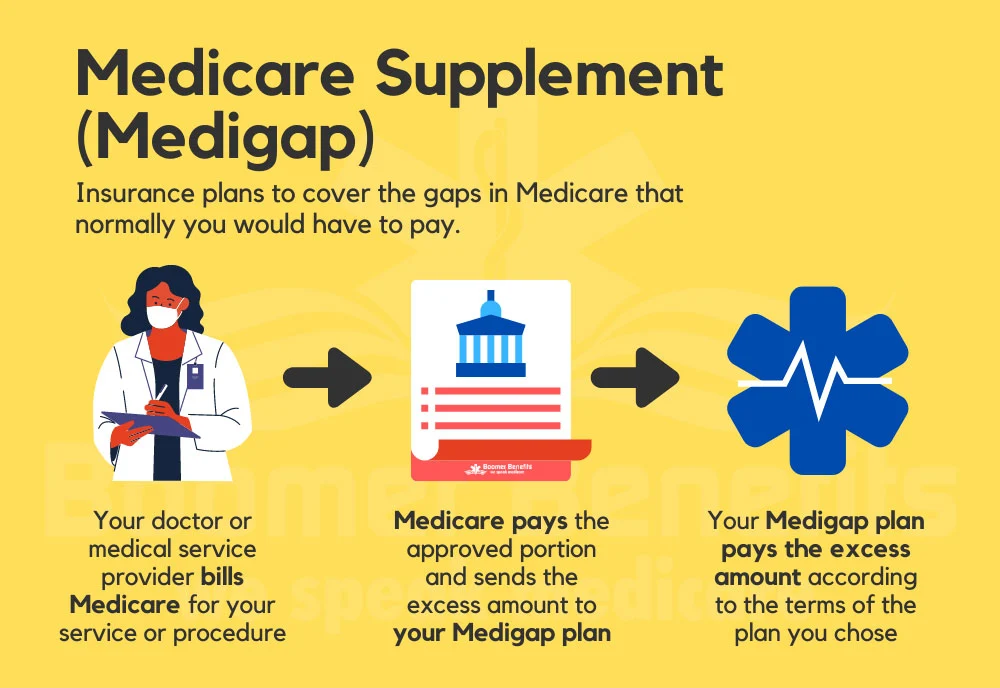

Medicare Supplement

Medicare Supplement (also known as Medigap) is an additional insurance policy that works with Original Medicare, and limits your out-of-pocket costs. Private insurance companies offer these plans, and beneficiaries can enroll and use them as a secondary insurance policy if they have Original Medicare. You cannot have both a Medigap and a Medicare Advantage Plan, you may only have one or the other.

There are ten Federally standardized Medigap plans available today, each labeled by a letter of the alphabet. They include Plans A, B, C, D, F, G, K, L, M, and N. Note that we use the word “plans” for Medigap policies versus “parts” for the parts of Medicare. It’s easy to see why so many people find Medicare confusing!

Medigap plans pick up the costs we talked about earlier, including the deductibles, copayments, and coinsurance that Parts A and B would otherwise leave you to pay. The costs picked up by your Medigap plan will depend on which of the letter plans you choose to enroll in. The most popular Medigap plans at this time are Plans F, G, and N.

Medicare Supplement premiums vary based on the plan you chose, the insurance carrier, and some personal factors like your age, gender, and zip code. New Medicare beneficiaries should expect to pay between $100 and $170 for a Medigap plan.

Get Expert Help!

You don’t have to struggle through the Medicare maze alone! The Medicare advocates at Medicare Savings Group are all licensed experts and we are more than happy to help you learn more about Medicare. We take the time to give you personalized, comprehensive expert advice so you can rest assured that you’ve got the best health insurance in place.

Our services are completely free and you never pay a penny more, so call us today or book an appointment!

What people are saying:

"I've never felt so grateful for help with our health insurance before. These guys are amazing!"

-Janice C.

Looking for Medicare Rates?

Frequently Asked Questions

What is Medicare?

Medicare is a Federal health insurance program for people 65 years or older, certain people with disabilities, and people with permanent kidney failure treated with dialysis or a transplant. Medicare has two parts – Part A which is hospital insurance, and Part B which is medical insurance.

Does Medicare pay for prescription drugs?

Generally, Original Medicare does not cover prescription drugs. However, Medicare does cover some drugs in certain cases such as immunosuppressive drugs (for transplant patients) and oral anti-cancer drugs. You should call your Durable Medical Equipment Regional Carrier for more information. Check the Important Phone Numbers section of this web site for the phone number. There are some Medicare Health Plans that cover prescription drugs. You can also check into getting a Medigap or supplemental insurance policy for prescription drug coverage. Medicaid may also help pay for prescription drugs for people who are eligible.

What is a Medigap policy?

Supplemental insurance policies are sometimes called Medigap plans. Medigap plans are private health insurance policies that cover some of the costs the Original Medicare Plan does not cover. Some Medigap policies will cover services not covered by Medicare such as prescription drugs. Medigap has 10 standard plans called Plan “A” through Plan “N”. Each plan has a different set of benefits.

Who is eligible for Medicare Part A (hospital insurance)?

If you have worked at least 10 years in Medicare covered employment you will qualify for premium free Medicare Part A (Hospital Insurance). To qualify, you must be:

- 65 or older; or

- Disabled and receiving disability benefits from Social Security or the Railroad Retirement Board for 24 months; or

- Have permanent kidney failure treated with dialysis or a transplant