Medicare Supplements Explained

Learning Medicare > Medicare Supplements Explained

Key Takeaways

- Costly Medicare mistakes are common if you miss your window to enroll and choose the wrong plan initially. Please talk to an expert who can guide you!

- You can also make mistakes, such as not reviewing your coverage each year and assuming your spouse has coverage.

- You can also get hit with a lifelong penalty if you fail to enroll in Part B when you have retiree insurance or CORBA.

What Are Medicare Supplement Plans?

A Medicare Supplement plan, also called a Medigap plan, are private insurance policies designed to help cover out-of-pocket costs not paid by Original Medicare (Parts A & B). Think of Medicare Supplement as the trusty sidekick to Medicare A & B which means helping pay for the for the items that Medicare A & B do not fully cover, like Coinsurance, Copayments, Deductibles, etc.

These plans come at an extra monthly cost which varies by location, age, gender, insurance company, plan type. etc. Those with a Medigap plan will still need to pay their Part B premium.

Medigap plans do not cover prescription medications, so those who have a Medigap plan should inquire about Part D medication coverage as an e

How Do Medicare Supplement Plans Work?

Simply put, Original Medicare (Parts A and B) is your base medical coverage. When you add in a Medicare Supplement plan, it works alongside Original Medicare to help pay for the costs that Medicare doesn’t. These plans cover up the “gaps” of Medicare Parts A & B.

Here are some of the costs Medicare Part A does not pay:

- The inpatient hospital deductible ($1,676 per benefit period in 2025).

- Daily inpatient hospital copays from days 61 to 90 ($419 per day).

- Lifetime hospital reserve days from day 91+ ($838 per day).

Here are some of the costs Medicare Part B does not pay:

- Medicare Part B coinsurance (20% with no out-of-pocket max).

- Medicare Part B deductible ($257 per year in 2025).

Once someone receives medical care, the medical office will forward the claim to Medicare. Once Medicare pays it’s responsibility, Medicare will then forward the claim to the Medicare Supplement insurance company to pay the remainder of the claim. Medicare Supplement plans pay after Medicare approves and pays its share of a medical claim.

Medicare Supplement Network

When you get a Medicare Supplement plan, you don’t switch networks or lose access to your favorite doctors. Instead, Medicare Supplements work alongside Medicare Parts A & B.

Here’s the best part: You’ll still have the same Medicare network. That means you keep your freedom to choose almost any doctor or hospital that accepts Medicare, which is over 95% of providers in the U.S.

So, when we say “no network” (in the traditional sense), we really mean it! You’re not tied down to a specific group of doctors or facilities. If a doctor or facility accepts Medicare, they’re required to accept your Medicare Supplement plan too. It’s that simple.

For those who travel or split time between multiple homes:

If you like to travel the country or have residences in different parts of the country, a Medicare Supplement plan is perfect, as you can use it anywhere Medicare is accepted. Whether you’re visiting family across state lines or enjoying a second home in a different city, your plan will travel with you. No need to stress about finding doctors who are “in-network” in different places.

What Are The Different Medicare Supplement Plans?

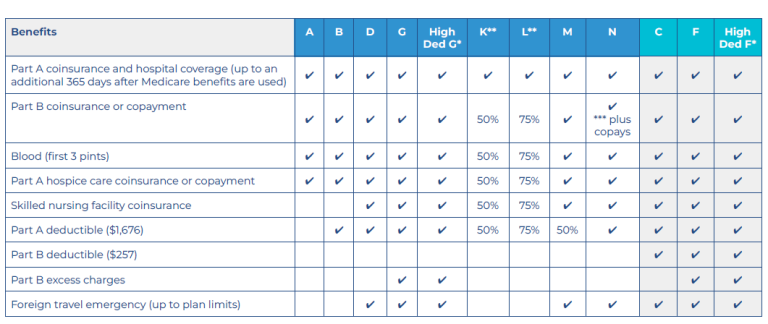

There are 10 standardized Medicare Supplement plans, A through N. Not every plan is available in every state, and some (like Plan C and Plan F) are only available to people who were eligible for Medicare before January 1, 2020.

Some Medicare Supplement plans will have higher premiums and offer more coverage. Other Medigap plans will have lower premiums because they have less coverage, and put some of the cost sharing responsibility on you. Take a look at our Medicare Supplement chart below so you can get an idea of your coverage options.

Notes on the above chart:

Medigap Plan G and F is also offered as a high-deductible plan by some insurance companies in some states. If you choose the high-deductible option, it means you must pay for Medicare-covered costs (coinsurance, copayments, deductibles) up to the deductible amount of $2,870 in 2025 before your policy will pay anything.

For Medigap Plans K and L, after you meet your annual out-of-pocket limit and your annual Part B deductible ($257 in 2025), the Medigap plan pays 100% of covered services for the rest of that calendar year.

In the above chart, everything with a checkmark means the benefit is covered 100% by the Supplement plan.

Plans K, L, and M have some percentages listed, and these are the amounts the Medicare Supplement plan pays towards those covered benefits, meaning you would be responsible for the remaining amount (either 25% or 50%).

Let’s go over the more popular Medicare Supplement Plan options:

Plan G

-

Covers everything except for the Medicare Part B deductible.

-

Most comprehensive plan available to new enrollees. We like to call this the “Cadillac Plan”, as it’s the new gold standard for Supplement plans.

-

Predictable costs, no copays and no surprises, but with a higher monthly premium.

Why people love it: “I just want the best coverage available and I want to know I’m covered.”

Plan N

-

-

Lower premiums than Plan G, but adds two copays you must pay:

- Doctors office copay: Up to $20

- Emergency Room copay: Up to $50

-

-

Doesn’t cover Part B excess charges.

-

Great if you don’t mind small out-of-pocket costs in exchange for a lower monthly premium while still having the main benefits as Plan G does.

Why people choose it: “I’m healthy and want to save money, but still have good coverage.”

Plan F

-

Only available to folks who became eligible for Medicare before January 1, 2020.

-

Covers everything, including the Part B deductible.

-

This used to be the gold standard plan, but is now being phased out due to due to the Medicare Access and CHIP Reauthorization Act (MACRA).

Why people choose it: “I’m eligible for it, I don’t want any out of pocket costs, and I don’t mind paying a higher monthly premium for the best coverage.”

2

How Do Medicare Supplement Plans Work?

Of the top mistakes people make, this one might be the most confusing and frustrating for consumers. There are many reasons why you need to compare Medicare paths (Supplement or Advantage) as well as individual plans (Supplement Plan Letter or Advantage plan type). Failing to do this can mean massive headaches and can be very costly down the road.

You have two main ways to get your Medicare benefits: Original Medicare (Part A and Part B) with a Supplement plan and a Part D prescription drug plan, or Medicare Advantage with a Part D drug plan rolled into one. There are advantages and disadvantages to each option, but you need to think through your health and budget needs before you choose.

Medicare Advantage plans tend to cost less overall, but they often have restrictions on where and how you get care. On the plus side, most include Part D prescription drug coverage, so you get all your Medicare benefits in one convenient plan.

Original Medicare with Supplement and a Part D plan may cost more in monthly premiums, but you can use them wherever Medicare is accepted. If you travel a lot or want the freedom to see any doctor or specialist you want, this path may be best for you.

The good news is that you get the opportunity to switch between the two paths if you make a bad decision. You’re not locked into a particular plan for life, although you have to be careful if you think you want Medigap. Miss your initial enrollment period, and you may not be able to buy it later if you have a pre-existing health condition.

3. Taking the same Medicare plan as your spouse/friend/co-worker/family member

Medicare sign-up mistakes come in many different forms. A common error in judgement (not your fault!) is enrolling in the same coverage as your friends, spouse, family, etc. While some Medicare Part A benefits can be shared among spouses, other components cannot. Furthermore, everyone’s healthcare needs are completely different. Just because a plan works for your spouse or a friend does not mean it will work for you. Every single person needs their own individually tailored Medicare plan, which suits their individual healthcare needs, wants, and budget.

Medicare is not like employer group insurance—you can’t add your spouse and/or dependent children to your plan. If you’re working at 65 and your younger spouse is on your employer’s plan, you need to weigh the financial consequences of switching to Medicare.

Another point to remember concerning spouses—Medigap and Part D are individual plans. That is, you can’t add your spouse to your plan; they need to buy a separate one. There’s also no spousal discount, so don’t feel you both need to choose the same plan. Your spouse may have different health care needs, so you each need to choose the Medicare plan that works for you.

Even if a person and their spouse share the same doctors, they still need to get their own individual Medicare plan which was selected for them personally, taking into account many different factors. This will ensure the bet possible outcome with their health insurance throughout their retirement.

4. Not Enrolling In Medicare When Necessary

One of the most common Medicare mistakes is failing to enroll in Original Medicare and/or Medicare Part D when necessary, and without having creditable coverage. By not enrolling when you’re eligible and when necessary, you’re subjecting yourself to lifetime penalties. Here are the penalties you risk when you are delaying Medicare:

- Although most people avoid penalties for Medicare Part A, those who do incur a penalty will be charged a 10% premium increase for double the number of years they didn’t have coverage.

- A Medicare Part B penalty is going to cost 10% of the current Part B premium added on to the regular monthly premium, and is based on each 12-month period that you forgo coverage despite being eligible. This penalty never goes away.

- The Medicare Part D penalty is also applicable to those who qualify for Part D but do not enroll and do not have creditable coverage through an employer or union. This penalty is 1% of the average annual Part D premium for each month of delayed coverage. This penalty never goes away.

5. Letting your Medicare Advantage or Part D plan renew without doing an analysis

Imagine shopping for a Medicare Advantage plan or Part D plan, finally finding the right one for you, and enrolling in the plan. A year or two goes by, and you go to the pharmacy and the medication you normally pay $25 for went to $125! t’s not a great feeling, and it’s one of the biggest Medicare enrollment mistakes anyone can make.

Premiums, drug prices, copays, deductibles, formularies, doctors, networks, and benefits all change over time, and each can affect how you’re covered or how much you pay. This is why you’ll want to revisit your coverage every single year (between October 15th and December 7th) whether you have a Medicare Advantage or a Part D plan, to avoid a sticker shock or loss of coverage later on.

Get an expert on your side to prevent these mistakes!

We help thousands of people every year navigate the massively complicated “Medicare Maze”. We’d be more than happy to lend our expertise and make this simple and easy for you so there’s no question that you made the best decision possible. Whether its doing an analysis on your current coverage versus Medicare, need help with enrollment, whatever it may be, we have your back!

To get our FREE expert assistance, call us at 717-942-8788 or click below to book an discovery call!

What people are saying:

"Great experience. Highly recommend for your Medicare needs"

-Bob W.

Looking for Medicare Rates?

Frequently Asked Questions

Inventore Veritatis Et Quasi Architecto Beatae Vitae?

Consequ Untur Magni Dolores Eos Voluptatem Sequin?

Inventore Veritatis Et Quasi Architecto Beatae Vitae?

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit.

Consequ Untur Magni Dolores Eos Voluptatem Sequin?

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit.

The Spaces

A descriptive paragraph that tells clients how good you are and proves that you are the best choice that they’ve made.

Work Floor

This is a short description elaborating the service you have mentioned above.

Full Kitchen

This is a short description elaborating the service you have mentioned above.

Conference Room

This is a short description elaborating the service you have mentioned above.

What We Have Here for You

A descriptive paragraph that tells clients how good you are and proves that you are the best choice that they’ve made.

24x7 Access

Augue Velit Cursus Nunc Quis Gravida Magna Mi A Libero.

Conference Room

Augue Velit Cursus Nunc Quis Gravida Magna Mi A Libero.

Printing/FAX

Augue Velit Cursus Nunc Quis Gravida Magna Mi A Libero.

Gigabit Internet

Augue Velit Cursus Nunc Quis Gravida Magna Mi A Libero.

Projector

Augue Velit Cursus Nunc Quis Gravida Magna Mi A Libero.

Week's Supplies

Augue Velit Cursus Nunc Quis Gravida Magna Mi A Libero.

Flexible Work Space

Augue Velit Cursus Nunc Quis Gravida Magna Mi A Libero.

Mail Delivery

Augue Velit Cursus Nunc Quis Gravida Magna Mi A Libero.

Pet Friendly

Augue Velit Cursus Nunc Quis Gravida Magna Mi A Libero.

Space to make your

greatest impact.

A descriptive paragraph that tells clients how good you are and proves that you are the best choice that they’ve made.

Frequently Asked Questions

Inventore Veritatis Et Quasi Architecto Beatae Vitae?

Consequ Untur Magni Dolores Eos Voluptatem Sequin?

Inventore Veritatis Et Quasi Architecto Beatae Vitae?

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit.

Consequ Untur Magni Dolores Eos Voluptatem Sequin?

Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nemo enim ipsam voluptatem quia voluptas sit aspernatur aut odit aut fugit.