Medicare Advantage Explained

Learning Medicare > Medicare Advantage | Written by Chris Blatnik

- Medicare Advantage plans are policies administered by private insurance companies, not with the Government like Original Medicare is.

- MA plans are an “all in one” alternative to Original Medicare. These plans typically include Rx drugs, dental, vision, and hearing coverage, as well as additional benefits.

- MA plans have networks that you must adhere to, or else you’ll be paying at a higher cost sharing rate, or even fully out of pocket, Some networks are larger and more lenient than others.

- There are specific enrollment periods for MA in which you can enroll and disenroll and change plans. You cannot get a MA plan anytime of the year

Medicare Advantage

Medicare Advantage, also known as Medicare Part C, and “MA”, are health insurance plans provided by private companies and approved by Medicare. These plans must offer at least the same coverage as Original Medicare – Part A and Part B.

Medicare Advantage plans are NOT the same thing as Medigap/Supplement plans – they are different. Members get their benefits from a private insurance company instead of Original Medicare, like with Medigap plans.

Medicare Advantage gives some additional benefits that Original Medicare does not provide. The most often added benefit is prescription drug coverage (Part D), which is included in almost every Part C plan, whereas with Original Medicare, you must purchase a separate Part D drug plan.

Let’s take a look at the eligibility, enrollment, and benefits of an Advantage plan.

How Medicare Advantage Works

A Medicare Advantage plan is a private Medicare insurance plan that you may join as an alternative way to get your Original Medicare (Part A and Part B) benefits. When you do, Medicare pays the plan a fee every month to administer your Part A and B benefits.

You must continue to stay enrolled in both Medicare Part A and B while enrolled in your Medicare Advantage plan. Medicare pays the Advantage plan company on your behalf to take on your medical risk. This is how Medicare Advantage plans are funded.

You will present your Advantage plan ID card at the time of your treatment. Your providers will bill the plan instead of Original Medicare. Again, this is also why some providers consider them Medicare replacement plans, but it’s important to remember that you can always return to Original Medicare during a valid annual election period.

Medicare Advantage Eligibility

If you are eligible for Medicare, you are eligible for a Medicare Advantage plan. You must be enrolled in both Medicare Part A and B before you can purchase a Medicare Advantage plan, and you must continue to pay your Part B premium!

The main requirements for Medicare Advantage is that you already have been enrolled in Original Medicare (Parts A and B), and that you live in the network area that the plan operates in. You cannot enroll in a great MA plan available in Erie, PA, if you live in Philadelphia, PA.

As for the requirements, the same eligibility criteria for Original Medicare are applied to Part C as well. So firstly you need to be a U.S. Citizen or a permanent resident of the United States for at least 5 years in a row, and you need to reside for six months each year in the plan`s service area.

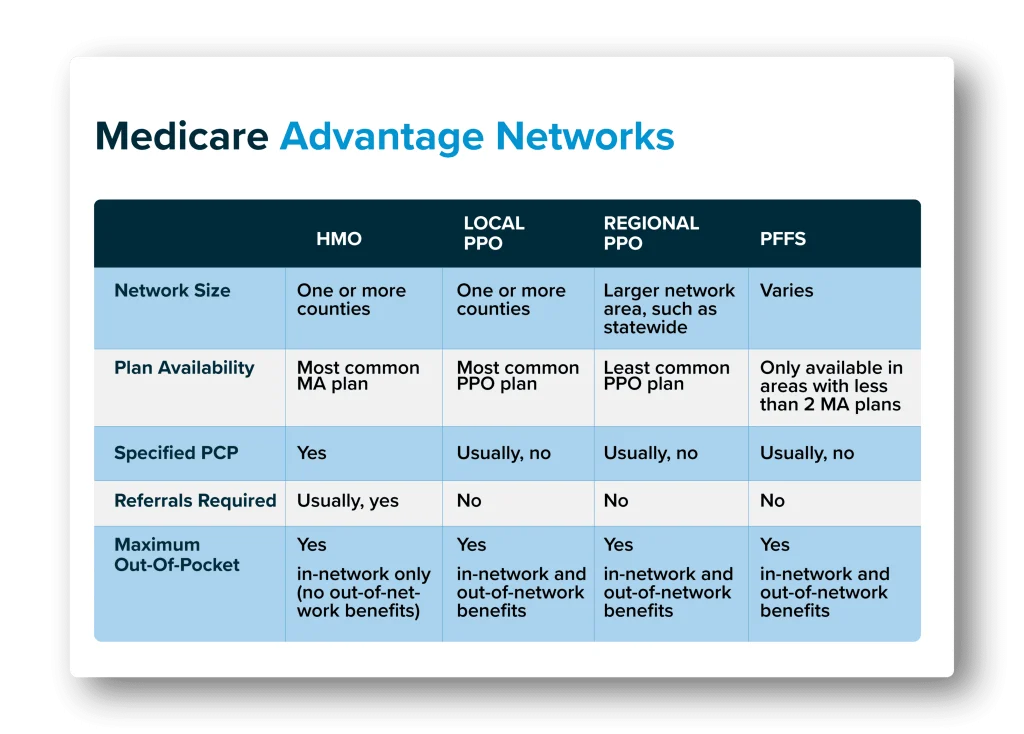

Medicare Advantage Networks

In exchange for the lower premiums that Advantage plans offer, you must agree to adhere to MA plan rules. Most Medicare Advantage plans have HMO or PPO networks:

Medicare HMO (Health Maintenance Organization) networks are the most common type of network. HMO plans are generally required to treat you only with in-network providers, except in emergencies. You will usually need to select a primary care physician, and that physician can coordinate a referral if you need to see a specialist. There are some HMO plans that offer a point-of-service feature where you can see out-of-network providers in certain circumstances. Most HMO offer lower costs to you, and have smaller networks than PPO’s.

Medicare PPO (Preferred Provider Organization) networks allow you to see doctors both in and outside the network, but you’ll have a higher out-of-pocket spending if you go out of network. With PPO plans you won’t need to select a primary care physician, nor will you typically need any referral for other doctors or specialists. Typically PPO plans come at a higher cost due to the expanded network and flexibility offered.

Private Fee-For-Service (PFFS) In limited areas of the country, there are MA plans called Private-Fee-for-Service plans. These plans may or may not include Part D. How you access care is also different. While this plan type was very common in the past, it has been slowly phased out in most areas. Read more about Medicare PFFS plans here.

Medicare Advantage Enrollment Periods

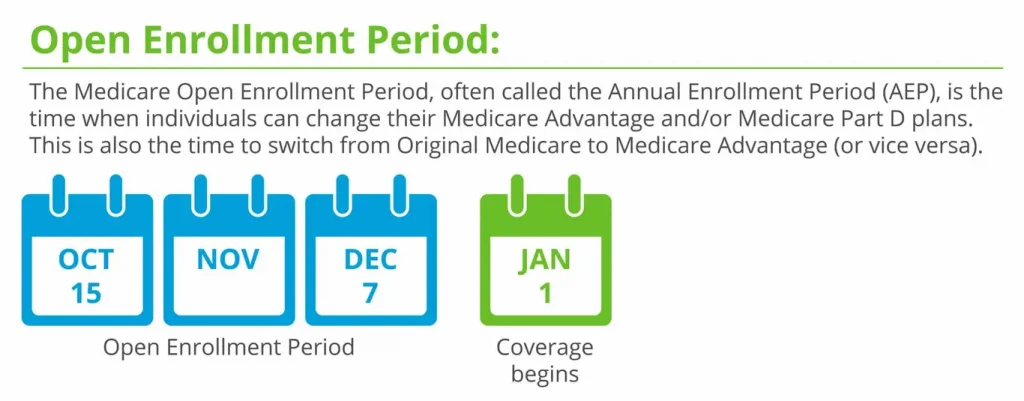

Medicare Advantage plans have lock-in periods, meaning there are times of the year where you cannot change your plan. You can enroll in a Medicare Advantage plan during the Initial Enrollment Period when you first turn 65. After that, you may enroll or dis-enroll only during certain times of the year. Once you enroll in Medicare Advantage, you must stay enrolled in the plan for the rest of the calendar year. You may only dis-enroll from an Advantage plan during certain times of the year unless you qualify for a special enrollment period due to a specific circumstance.

Annual Election Period – Oct 15 to Dec 7

The Annual Election Period (AEP) and also called the Open Enrollment Period (OEP), is the most common time to change your Medicare Advantage plan. This period runs from October 15th – December 7th each fall. Changes made to your enrollment will take effect on January 1st of the following year. This time of the year is when you will see non-stop Joe Namath and other Medicare commercials, see increased junk mail, and have your phone ringing off the hook. Notice how after December 7th passes, most of the Medicare advertising stops!

During this time, you can join, drop, and switch from one Medicare Advantage plan to another Medicare Advantage plan. You may also leave Original Medicare and choose a Medicare Advantage plan, or vice versa.

Medicare Advantage Open Enrollment Period – Jan 1 to March 31

Unfortunately, this does not guarantee that you can return to the Medigap plan you had before, if you had one previously. Unless this was your first time ever in a Medicare Advantage plan, then you will usually have to answer health questions and go through medical underwriting to get re-approved for Medigap. Consider this before dropping any Medigap plan to go to Medicare Advantage.

Medicare Advantage Coverage

Medicare Advantage coverage for inpatient care, in general, is covered by Medicare Part A. Regarding Part C, it covers the same services as Medicare Part A, including inpatient hospital care and inpatient care in the skilled nursing facility. Part C also covers Home health care, but hospice care benefits remain under Original Medicare (Part A and B).

As for coverage for outpatient care, which is covered by Part B in general, Medicare Advantage covers the same benefits as Part B, including visits to primary care doctors or specialists, tests and x-rays, emergency ambulance services, mental health services (both inpatient and outpatient), durable medical equipment, vaccines, physical or occupational therapies, and speech and language pathology.

There are a few extra benefits that Medicare Part C can cover, but Original Medicare does not. Some of these services that Medicare Advantage may include as extra benefits are: Routine dental, vision, and hearing care, fitness benefits such as exercise class (SilverSneakers membership), emergency medical assistance while traveling outside the U.S., and allowance to buy health care products. But not all Medicare Part C plans cover these mentioned extra benefits, as well as they are not limited to them.

Medicare Advantage Costs

There is a wide range of plan costs. Many people choose low-cost or free plans, and $0 Medicare Part C plans are available in 49 states. On the other side, some plans can cost several hundred dollars per month. Expensive plans usually provide better benefits such as a broader network of medical providers, more coverage for specialized care, or better cost-sharing benefits.

Medicare Part C costs are determined by several factors, such as premiums, deductibles, copayments, and coinsurance. These amounts can range from $0 to hundreds of dollars for monthly premiums and yearly deductibles. But most of your Part C costs will be determined by your chosen plan. Here below are some of the most common factors affecting Part C plan cost:

- Premiums: Some Medicare Part C plans are free, meaning they don’t have a monthly premium. But even if it is a $0 premium, you may still owe the Part B premium.

- Deductibles: Most Medicare Part C plans have both a plan deductible and a drug deductible. Some of the free Medicare Advantage plans offer a $0 plan deductible.

- Copayments and coinsurance: Copayments are amounts you will owe for every doctor’s visit or prescription drug refill. Coinsurance amounts are any percentage of services you must pay out of pocket after your deductible has been met.

- Plan type: The type of plan you choose can also have an impact on how much your Part C plan may cost.

- Out-of-pocket maximum: One advantage of Medicare Part C is that all plans have an out-of-pocket maximum.

- Lifestyle: Most Medicare Advantage plans are location-based because they depend on the provider`s network. This means that if you travel often, you may find yourself stuck with out-of-town medical bills.

- Income: Your yearly gross income can also factor into how much you will pay for your Medicare Part C costs. Individuals with higher incomes will have higher Medicare costs.

Types of Medicare Advantage Plans

There are four main types of Medicare Advantage plans offered: Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, Private Fee-for-Service Plans (PFFS), and Special Needs Plans (SNP).

There is also a Medicare Advantage Medical Savings Account Plan (MSA), which covers benefits from Original Medicare and gives additional benefits. But MSA is specific that they come as a high deductible health plan with a bank account to help you pay for your medical costs. For a detailed breakdown read out a blog about Medical Savings Account plans.

Health Maintenance Organization Plans

To enroll in a Medicare Advantage Health Maintenance Organization plan, you must already be enrolled in Original Medicare. If you are, then you are eligible to enroll in a Medicare Advantage HMO plan in your state. All Medicare Advantage HMO plans must have Original Medicare coverage for hospital and medical insurance. But most HMO plans also include Part D (prescription drug coverage), dental, vision, and hearing services, and some additional health coverage such as fitness membership or home meal delivery.

HMO plans provide health care coverage from doctors, other health care providers, or hospitals in the plan’s network. Simply, it means that you are given a list of in-network providers to choose from when you need medical services. If you decide to select a provider who is out of network, you will pay the out-of-pocket amount for those services.

Medicare Advantage HMO plans may have their own monthly premium unless they are premium-free plans. They generally have their own in-network deductible amounts, which can start as low as $0. HMO plans have different copayment amounts for Primary care doctor and specialist visits (it can range from $0 to $50 per visit). After the yearly plan deductible has been met, usually you will pay 20% of the Medicare-approved costs for the services you receive.

The main benefit of the Medicare Advantage HMO plan is simplicity, meaning that you only have to manage one plan instead of many of them. In addition to that, a Medicare Advantage HMO plan also controls how much of your own money you have to spend. HMO plans, unlike Original Medicare, have out-of-pocket maximums, meaning that you will spend only a certain amount of money before the insurance company covers the rest of the expense.

Preferred Provider Organization Plans

Medicare Advantage Preferred Provider Organizations (PPO) plans are the most popular healthcare plan choice for additional coverage. This plan’s greatest advantage is that you can go to your preferred doctors, specialists, and healthcare facilities, whether or not they are in your plan’s network. Also, a huge advantage of PPO plans is that you do not need a doctor`s referral to visit a specialist.

PPO plans can charge their own monthly premium (Part B premium excluded). They can charge a deductible amount for both the plan, as well as the prescription drug portion of the plan. Copayment amounts can differ based on whether you visit a doctor or specialist that is in-network or out-of-network. Regarding the out-of-pocket maximum, with a Medicare PPO plan, you will have both an in-network maximum amount and an out-of-network maximum amount.

Private Fee-for-service Plans

Medicare Advantage Private Fee-for-service plans have a contracted network of providers, so you can see a list of the network providers who have agreed to always treat PFFS plan members. If you go to a doctor, other health care provider, facility, or supplier who is not on the plan’s network for non-emergency or non-urgent care services, your plan may not cover your services, or your costs could be higher. Some PFFS plans include prescriptions for drugs. The advantages of PFFS plans are that you do not need to have primary care doctor and you do not need to get a referral from a primary care doctor to see the specialist.

Special Needs Plans

Medicare Advantage Special Needs plans limit membership to people with specific diseases or conditions. They almost always have specialists for the diseases or conditions diagnosed with beneficiaries. The great advantage of this kind of plan is that all Special Needs Plans plans provide drug coverage (Medicare Part D). On the other hand, you are required to have a primary care doctor, as well as a referral if you need to see a specialist.

SNP plans are meant for people who live in certain institutions (like nursing homes) or who live in the community but require nursing care at home, for people who are eligible for both Medicare and Medicaid, and for people who have specific chronic or disabling conditions. If eligible for Medicare Advantage Special Needs Plan, you can enroll in it at any time.

Medicare Advantage and TRICARE

TRICARE is another health insurance program offered to active and retired military personnel, their spouses, and dependents. It offers comprehensive medical benefits and is accepted all over the world. If you are 65 and have TRICARE, you are also eligible for Medicare, as well as for Medicare Advantage.

If you choose to enroll in Medicare Advantage besides TRICARE, your Medicare Advantage plan will be your primary insurance plan and TRICARE your secondary plan. However, you may need to be more careful about where you receive care because Medicare Advantage requires you to take services in their network of providers.

Medicare Advantage plans do not coordinate automatically with TRICARE. That means that after your Part C plan pays on a claim, you may need to file the secondary claim with TRICARE yourself.

For all other Medicare Advantage questions, you can talk with one of our Medicare consultants or agents.